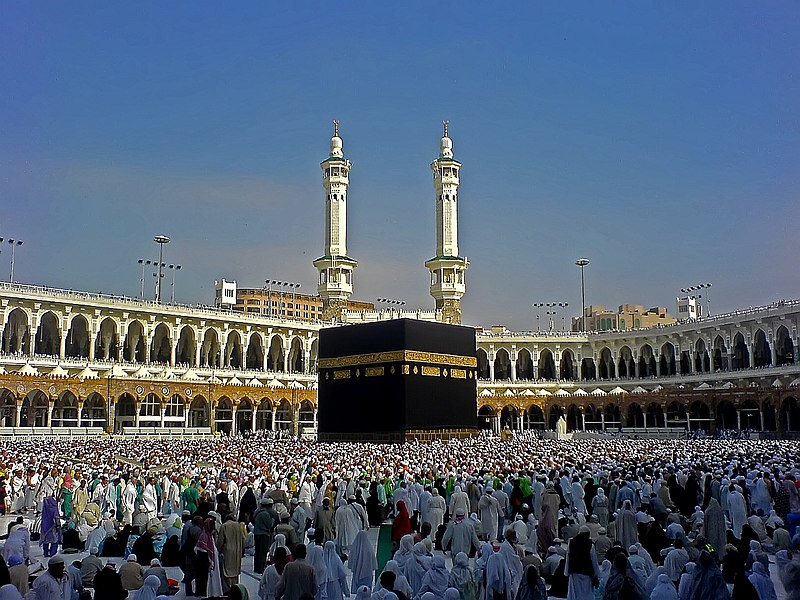

Saudi Arabia's non-oil private sector growth lost some momentum in April, as a sharp slowdown in new orders pulled back overall expansion, according to a survey released on Monday.

The seasonally adjusted Riyad Bank Saudi Arabia Purchasing Managers' Index (PMI) fell to 55.6 in April from 58.1 in March—its lowest point since August 2024, though still well above the 50.0 threshold that marks growth.

New orders, a key driver of activity, dropped for the third straight month, with the subindex falling to 58.6 from 63.2 in March. Analysts attribute the dip to global economic uncertainty and heightened competitive pressures.

"Output growth remains solid, but external factors are weighing on client spending," said Naif Al-Ghaith, chief economist at Riyad Bank. "Still, the steady rise in employment points to a healthy underlying trend that’s persisted since May of last year."

Hiring surged at one of the fastest rates in over a decade, fueled by increased business activity and sales, as companies scaled up staffing to meet demand.

Despite the uptick in jobs, business confidence lagged behind the long-term survey average.

The broader Saudi economy grew by 2.7% in the first quarter of 2025, led by the non-oil sector, as the kingdom continues its push to diversify away from oil. To better reflect this shift, the national statistics authority has updated its data methodology to give greater weight to non-oil activities, aligning with international standards. Photo by Ali Lajami, Wikimedia commons.