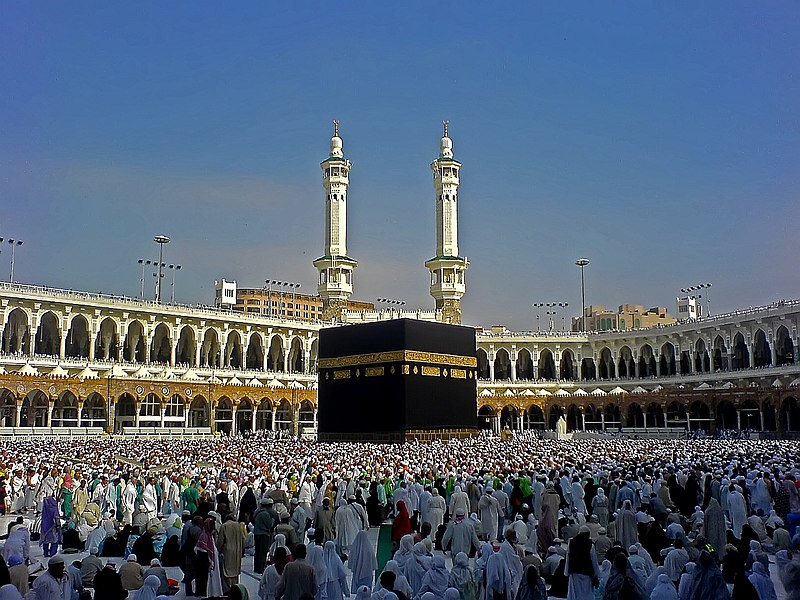

Visa, the global leader in payment card services, has announced the launch of its Flexible Credential solution in both the US and the UAE, partnering with Affirm and Liv respectively.

With this expansion, Visa aims to provide consumers greater flexibility and control over their payment options. In the US, Visa’s Flexible Credential is being introduced with the Affirm Card, a debit card that allows eligible users to utilize Buy Now, Pay Later (BNPL) options through the Affirm app. Meanwhile, Liv’s Flexible Credential in the UAE offers frequent travelers access to multiple currency accounts with a single card, simplifying cross-border payments. Visa representatives emphasized that these collaborations with Affirm, Liv, and SMCC enhance Visa’s commitment to optimizing payments for consumers, allowing the company to meet diverse consumer needs and preferences through expanded payment choices.

Enhanced Payment Convenience and Flexibility

In the US, Affirm is among the first companies to adopt Visa’s credential solution for its users. The Affirm Card enables consumers to choose whether to pay upfront or in installments, available wherever Visa is accepted. This partnership allows Affirm Card users to easily toggle between immediate payments or BNPL options directly within the Affirm app.

In the UAE, Liv’s multi-currency solution empowers users with access to various currency accounts on a single card, simplifying international spending. Visa’s Flexible Credential automatically routes each transaction to the appropriate currency account based on the payment location, whether online or in-store. Using Liv’s mobile app, cardholders can manage funds between local and foreign currency accounts. This feature supports currencies such as USD, GBP, EUR, CAD, and AUD and is accessible to both new and existing Liv customers.

Supporting Small Businesses with Flexible Payments

In collaboration with SMCC, Visa has also launched a new feature within the Visa Flexible Credential to support small businesses with credit access and cash flow management. The Olive Card now enables small businesses to easily switch between personal and business accounts, enhancing financial flexibility. Visa continues to test this solution in Japan with SMCC and plans to extend it to other global markets in the near future.

With these expanded offerings, Visa continues to lead in delivering innovative payment solutions that cater to consumers’ and businesses’ evolving needs in today’s global economy. Photo by Petr Kratochvil, Wikimedia commons.