Stock markets across the Gulf region bounced back strongly in early trading on Tuesday, mirroring a positive trend in Asian markets and recovering from a recent global selloff. The rally was

fueled by renewed optimism that the United States may be open to revisiting and potentially negotiating some of its hefty import tariffs, a move that could ease trade tensions and boost investor confidence worldwide.

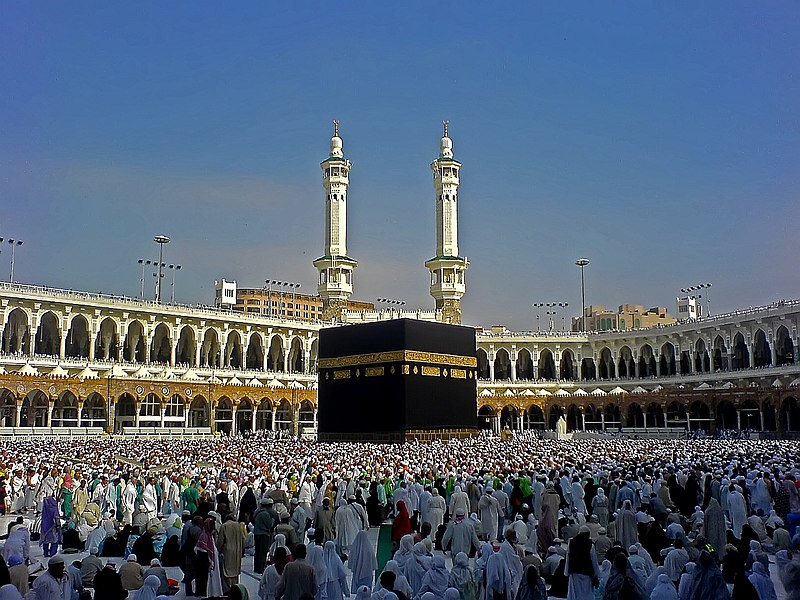

Saudi Arabia's benchmark index, the Tadawul All Share Index (TASI), climbed by 2%, building on momentum from the previous trading session. Financial stocks were among the main drivers of the rally. Al Rajhi Bank, one of the kingdom’s leading Islamic lenders, saw its shares rise by 2.3%. Meanwhile, Saudi National Bank—the country’s largest financial institution—also posted solid gains with a 2.1% increase in its stock price.

The rebound comes as regional investors track global developments closely, particularly signals from major economies like the U.S. and China, whose trade policies and negotiations significantly impact global market sentiment. Tuesday’s early surge across Gulf markets reflects a cautious yet growing sense of relief that the worst of the recent downturn may be over, at least for now.

Other Gulf markets are also expected to reflect this upward trend as the trading day progresses, buoyed by improving sentiment and a slight easing of fears surrounding international trade disruptions. Photo by Richard Mortel from Riyadh, Saudi Arabia, Wikimedia commons.